This post may contain affiliate links please read our disclosure for more info.

Image credit: getchip.uk

Wouldn’t it be great if you didn’t have to think and plan every saving that you made each month? It would make saving easier and achievable for those of you who want to save, but struggle to actually do it. Help is at hand on your smartphone. There are now a multitude of general finance and savings apps on both IOS and Android platforms. Below I have given an overview of my top 5, and listed their key features.

Automatic Savings Apps

Money Box

Money Box is a savings app that allows you to invest your spare change from everyday purchases. Over time you can build up your investments with money that you will not miss. Your money can be invested into a Stocks and Shares ISA, Lifetime ISA or general investment account. You can start with £1. More details here.

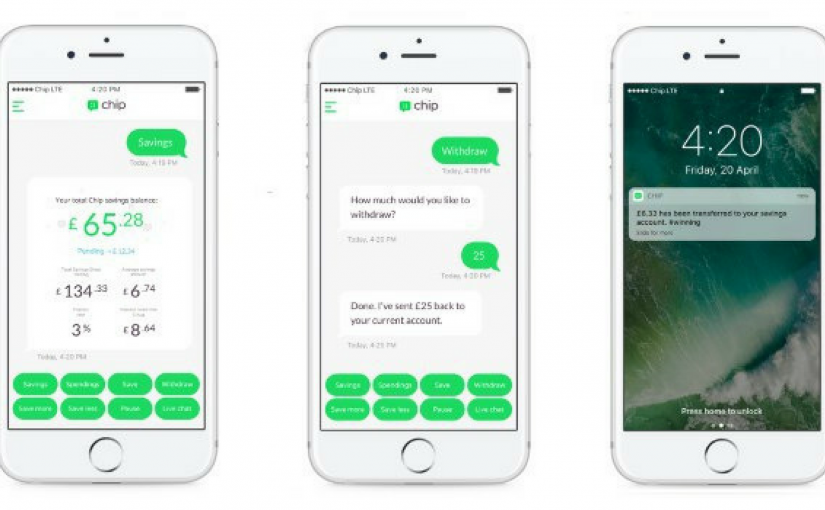

Chip

The Chip App is similar to Money Box in that it enables you to save spare change against goals that you determine. Please be aware that you need to give the app read only access to your bank account; this fact alone will put some people off. As with every app or account that I mention on this website, always do your own research and only move forward if you are comfortable to do so. More details here.

Money Farm

Money Farm is a wealth management app designed to make investing accessible. Created with families in mind, Money Farm gives its users access to investment advice and well structured investment products. Money Farm operates in the UK and Italy. More details here.

Money Dashboard

As the name suggests, Money Dashboard is a way to keep track of your financial accounts by viewing one dashboard rather than many different websites. It is an account aggregator that makes it very easy to budget and also track spending, The app currently has over 150K users. More details here.

Plum

Plum is not actually not an app, it is a Facebook chatbot and has the same purpose as Moneybox and Chip, allow its users to save without really trying to. The chatbot analyses your transactions, identifies regular income, bills and daily expenditure to calculate an affordable amount that you can save. Your savings are moved to a protected account and then can be invested with RateSetter, who are a peer-to-peer lender. More details here.

For each of these apps, do you own research and make sure that you read the Google reviews too. If you are using an app or website to invest in the stock market remember that Stocks can go down as well as up. Plan to invest for the long term.

Are you currently using any of the apps mentioned in this post? How are you getting on? Let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

What are the Best Savings Accounts for Children?

How to Teach Your Children About Money

How to get Value for Money When Buying Foreign Currency

Save up to £500 Per Year With a Sim Only Mobile Phone Deal

What’s the Best Strategy for Clearing Debts?

What are the Different Types of Savings Accounts?

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike