This post may contain affiliate links please read our disclosure for more info.

Image credit: https://www.propertyguardians.com/

Please make sure you are sitting down as you start to read this post. It is possible to save hundreds of pounds per month on rent in central London and some other cities across the UK. You can live in prime locations for just a few hundred pounds a month as a Property Guardian. Across the UK and dare I say it, the world, accommodation is the largest monthly expense for adults. This is an opportunity for those who are flexible to significantly reduce their monthly accommodation expenditure.

What is a Property Guardian?

There are property owners in London and other cities, who have to leave their properties empty for a period of time. Perhaps, they have to work abroad for work or have taken a sabbatical to travel the world. There are also commercial property owners. Whatever the reason this group of people would now need to employ a security firm to oversee the property in their absence and ensure that it is well maintained and free from vandalism and squatters. This is where Property Guardians fit in. Property Guardians are essentially live in caretakers who look after the property in return for a heavily reduced monthly rent.

How Does it Work?

People who are interested in becoming Property Guardian should contact one of the entrepreneurial companies that have been set up in this space. There are over 30 now, some are national whereas others are have a London focus, click here to visit the website of Global Guardians, or here to visit dotdotdotproperty.com . The second company is a Social Enterprise and takes a different approach to the for profit companies.

It Seems Too Good to be True

Well, funny that you should think that, there is a potential downside too. What you are looking for is a clean, convenient space with basic amenities that enables you to look after a property in return for a heavily reduced rent. There are two clear benefits for the property owner, first of all they get a live in caretaker. Secondly, when commercial properties are converted into residential dwellings they can save thousands in business rates reductions.

Unfortunately not all property Guardians have not had positive experiences, there have been instances where some Property Guardian companies have increased rents for Guardians and failed to maintain basic amenities including showers and kitchens.

My recommendation is that you do your own research; if you are flexible and can find a reputable company and good location – go for it! It could be a great way to live more frugally and help you to save money for travelling or some other major expense. I would not recommend Property Guardianship for families.

Have you ever been a Property Guardian? What was it like? Let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

4 Obstacles you Will Face on Your Financial Journey

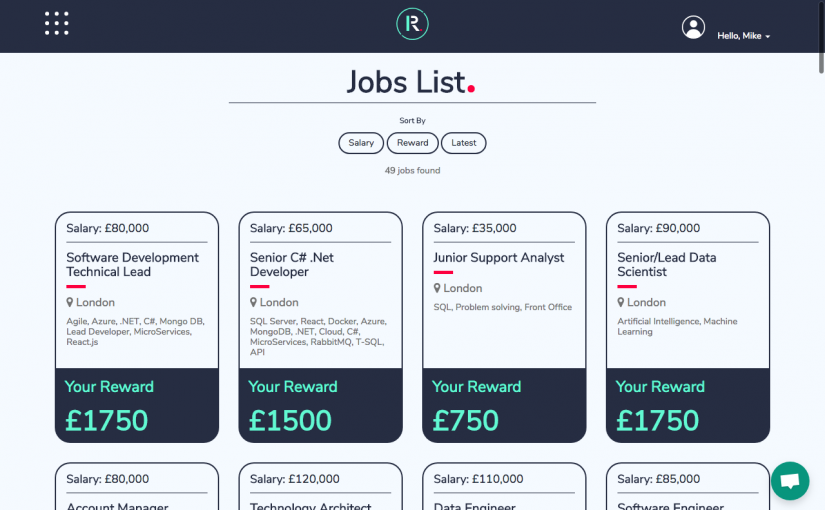

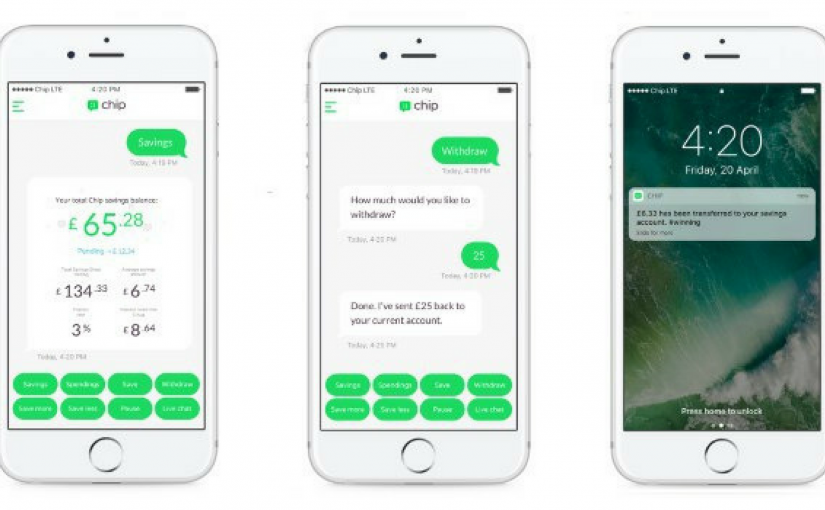

Make Money Now With These Two Referral Apps

Have you got the Right Money Mindset?

What to do with a Financial Windfall

Why you Should Track Your Net Worth

Have you saved Enough into Your Pension?

Are you and Your Partner Financially Compatible?

What are the Best Savings Accounts for Children?

How to Teach Your Children About Money

How to get Value for Money When Buying Foreign Currency

Save up to £500 Per Year With a Sim Only Mobile Phone Deal

What’s the Best Strategy for Clearing Debts?

What are the Different Types of Savings Accounts?

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike