This post may contain affiliate links please read our disclosure for more info.

Image credit: https://www.thebudgetmom.com/

The next stage up from following a monthly budget is living off a cash budget for a week or a month. If you are not already following a monthly budget, please read this post, How to Create a Budget That you can Stick to; that post will help you create your monthly budget. For those of you already following a monthly budget, the cash budget could be for you. Following a cash budget will enable you to make further financial gains.

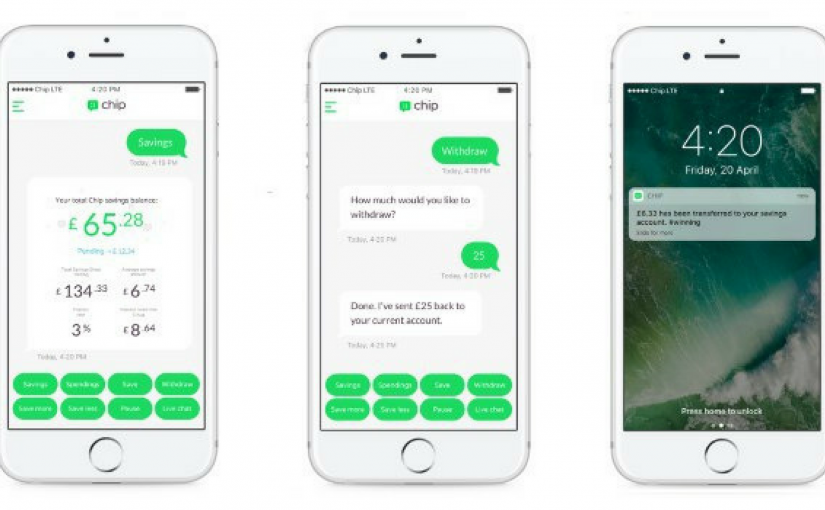

What is a Cash Budget?

Each month you receive your salary or pay cheque, when you do you should pay all of your bills and account for your needs. There will be money left over that you allocate to discretionary spending; items such as groceries and entertainment will fall into this category. For each of these items of expenditure you are going to withdraw the money from your account and place the money in an envelope. For example, if you have allocated £200 for entertainment during the month, you must place £200 in the entertainment envelope. Once that entertainment envelope is empty, you have run out of money for entertainment until next month. The same applies for all the other sub categories.

The Benefits of a Cash Budget

The beauty of the cash budget system is that you will physically see how much you spend on different items of expenditure. Compare that to contactless payments with plastic cards and no receipts, a scenario that makes it so easy to lose track. When you are living with a cash budget, do not steal from one envelope to make up for a shortfall in another. Your envelopes will become emptier as the month progresses; you might find that you are spending a lot on entertainment, groceries or lunches at work.

If you are disciplined, the cash budget system will make you more intentional about everything you spend your money on. This will mean greater control of your finances, which in turn will mean that you improve your net worth and achieve your financial goals more quickly.

It may be that you need to make more money, if that is the case the ideas contained in this post will help you, 10 Ways to Make Money Now.

What if you Have Money Left Over?

If you have money left over in some sub categories and shortfalls in others, you may need to re-visit your monthly budget and make some changes. If you have money left over and no shortfalls it would be advisable to increase the amount that you are saving.

The ideal scenario is for your first experience with a cash budget to be a positive one and for a new habit to be created. Research has confirmed that paying with cash will make you more conscious of every expenditure. Many people have attributed their success in paying off debts and achieving savings targets to the fact that they have used a cash budget.

Your Challenge

Your challenge, should you choose to accept it, is to live off a cash budget for one week. Split your money into budgets for the different sub categories and then live out of the envelopes on a day to day basis. I would love to hear about any progress that you make. Also, feel free to tell me about anything you found particularly difficult and how the overall process made you feel about your personal finances.

Let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

Has the Cryptocurrency Bubble Burst?

Why you Should Drive and Old Car and Pay of Your Mortgage Early

Make Money By Being Part of a Focus Group

Save Hundreds on Rent Per Month By Becoming a Property Guardian

4 Obstacles you Will Face on Your Financial Journey

Make Money Now With These Two Referral Apps

Have you got the Right Money Mindset?

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike