This post may contain affiliate links please read our disclosure for more info.

Image credit: https://smartereum.com/

Unless you have been living under a rock for the past ten years, you will have heard of cryptocurrencies. Cryptocurrencies are decentralised digital currencies based on blockchain technology; a cryptocurrency enables value to be transferred from point A to point B without an intermediary; traditionally your bank or a company such as PayPal would act as the intermediary.

The value transfer is validated via a distributed ledger. Blockchain technology, which provides the technological platform for cryptoocurrencies, has the potential to disrupt many industries in addition to the financial services sector. Most people outside of the sector, associate blockchain technology with cryptocurrencies and refer to Bitcoin when thinking about cryptocurrencies.

Cryptocurrencies: Origin and Development

Bitcoin was the first cryptocurrency created. It was created by Satoshi Nakamoto in January 2009, the identity and whereabouts of Satoshi remain one of Bitcoin’s mysteries but what is clear is that Bitcoin has disrupted the financial services industry ever since. Subsequently, many other cryptocurrencies have been introduced with Ethereum being one of the most significant. For more information about how cryptocurrencies work from a technological standpoint, read this article.

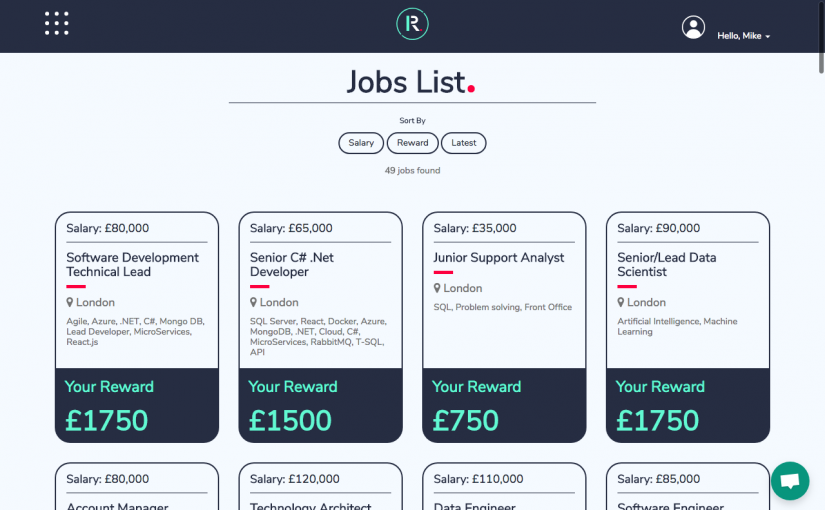

A new cryptocurrency is introduced to the market via an Initial Coin Offering (ICO), a fundraising exercise similar to Initial Public Offerings (IPO). These ICOs enable new companies to finance their blockchain technology based projects. The company’s founders and development team behind each project will write a whitepaper to explain their vision and plan. Potential investors research projects, read the respective whitepapers and invest in companies via ICOs. This website show’s the current market price for the hundreds of cryptocurrencies now in existence.

Cryptocurrencies as Investments

The success of ICOs and the emergence of Bitcoin millionaires attracted many individuals motivated purely by financial gain. Bitcoin, once priced at just a few cents in United States currency ( Pre 2012) experienced a rise in price up to $19,783.06 in December of 2017. It’s current price is $6,672.98.

In a lot of cases, ICOs were launched with no intention of delivering on a project, they were money making scams; the people behind them disappeared after the process. In recent years, the vast majority of new coins are worthless. Buying cryptocurrencies is akin to gambling at a casino or at betting on a horse. Extreme price volatility is standard as is the chance that the promising coin you bought with be worthless in 12 months.

Has the Cryptocurrency Bubble Burst?

Cryptocurrencies are here to stay, it is no coincidence that the start of the current bear market coincided with an influx of institutional investors trading bitcoin futures on the Chicago Board Options Exchange and the CME Group exchange from December 2017. Many of these professional investors began ‘shorting’ bitcoin. In layman’s terms, this means they bet on the price of bitcoin going down. Large financial institutions have now investments in bitcoin, it appears that cryptocurrencies are now part of the investment landscape; they are not in a bubble. Bitcoin and other cryptocurrencies have been down before and bounced back. My guess is that this will happen again and like many I hope to be in a position where I can capitalise.

What Should You do?

First of all, do your research and if you are still keen to buy cryptocurrencies, Coinbase is a relatively safe place to start. You can sign up for Coinbase here and because I referred you, when you sign up and buy or sell $100 of bitcoin or more, we’ll both earn $10 of free bitcoin!

Have you bought any cryptocurrencies? What has been your experience? Let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

Make Money By Being Part of a Focus Group

Save Hundreds on Rent Per Month By Becoming a Property Guardian

4 Obstacles you Will Face on Your Financial Journey

Make Money Now With These Two Referral Apps

Have you got the Right Money Mindset?

What to do with a Financial Windfall

Why you Should Track Your Net Worth

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike