This post may contain affiliate links please read our disclosure for more info.

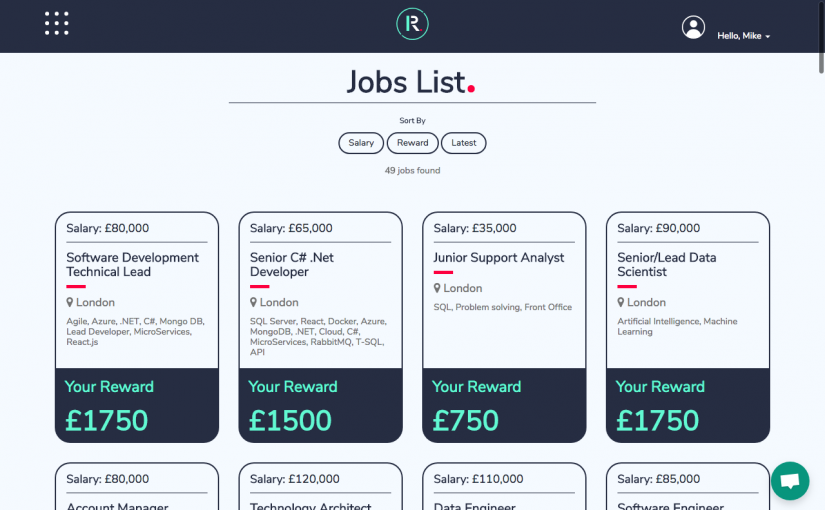

Image credit: http://www.yourmoney.com/

I am convinced that the water supply companies are no more virtuous than gas and electricity suppliers. If you have read my post of a couple of weeks ago, entitled Save Money by Switching Energy Supplier Every Year you will know that my recommendation is to review your energy supplier every year and then visit a comparison website. Your objective is to switch to the best value for money deal available for your post code.

Unfortunately, you cannot do the same with your water supplier. The water supply industry has not been deregulated in the way that gas and electricity has. What does this mean? The water supply companies have localised monopolies and consumers can do nothing about it. For example, I cannot change my water supplier; Thames Water will remain my supplier whether I like it or not.

What can you do?

Install a Meter

If you have been paying water bills as unmetered charges, the chances are that you will save money by switching to a metered bill. Visit the website of your supplier and request that a meter is installed to track your actual water usage. Water companies should inform you that you would benefit from having a meter installed but in many cases they do not. If a meter cannot be fitted you will get an assessed bill.

Reduce Your Water Usage

Below are a list of simple steps that you can take to reduce your water usage:

Limit the amount of time everyone takes having a shower. Shorter showers will mean less usage.

Avoid taking baths for the same reason.

If you have a dishwasher, ensure that you only use it with a full load. If you still wash up by hand, do so once a day with a sink full rather than several times a day.

Limit the amount of washing machine loads you wash per day and per week. Ensure that you wash full loads only.

Clean your car with a waterless instant shine cleaning product like this one, instead of using buckets of water and soap. Click on the text in red to be taken to an example.

Collect rain water in a water butt and use that ( and a watering can) to water your plants rather than using a hose pipe.

Avoid using a hosepipe in any scenario.

In the bathroom, avoid running taps when shaving or brushing your teeth.

Store cold tap water in the fridge rather than running a tap until it’s cold enough to drink.

If you have any leaky taps or shower heads, fix them.

Using a combination of these methods will definitely reduce your water usage and bill without you having to make any major changes to your lifestyle. Please take action today and let me know how you get on.

Are you already taking steps to reduce your water usage? Have you discovered any other ways? Please let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

How to Stick to Your Budget During Summer: 5 Tips

Does Your Choice of Supermarket Matter?

Save Money by Switching Energy Supplier Every Year

How to Stop Impulse Buying – 10 Ways

Have you Found all of Your Dormant Accounts?

Can you live off a Cash Budget for a Week?

Has the Cryptocurrency Bubble Burst?

Why you Should Drive and Old Car and Pay of Your Mortgage Early

Make Money By Being Part of a Focus Group

Save Hundreds on Rent Per Month By Becoming a Property Guardian

4 Obstacles you Will Face on Your Financial Journey

Make Money Now With These Two Referral Apps

Have you got the Right Money Mindset?

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike