This post may contain affiliate links please read our disclosure for more info.

It is very unfortunate that the people who most need credit are the least likely to receive it. People with low credit scores are deemed the greatest risk by the bean counters in banks and other financial institutions who determine who’s loan application will be accepted or denied. When you are being considered for any credit agreement, one variable that carries a lot of weight is your credit score. This is expressed as a number; fortunately, it is a variable that you can positively influence over time.

What is a Credit Score?

Definition: As a consumer, your credit score is a number based on information from your credit reports at the three major credit reporting bureaus – Equifax, Experian and TransUnion.

Definition from Investopedia.com

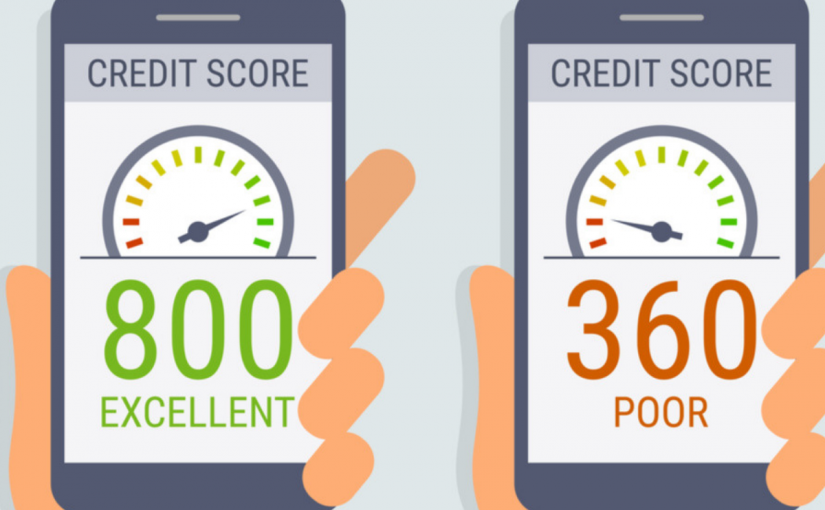

Your credit score* is based on your performance against a number of factors including, how much credit you are currently using, whether you have missed payments for credit cards and loans, whether you are a home owner or rent the property that you currently live in. According to Experian, a poor credit score is between 300-579, 580-669 is described as fair, 670 -739 is labelled good, 740-799 is very good and 800 to 850 is exceptional. People with poor credit scores are often turned down when they apply for credit.

Image credit: https://www.experian.com/

How can you Improve Your Credit Score?

There are a number of ways of improving your credit score, for the purpose of this blog post, I will focus on one. You can Improve your credit score by applying for a specialist credit card, using it responsibly and building up positive data points and your financial reputation. ‘Using it responsibly’ in this context means paying off your balance each month and making payments on time. Credit cards for people with low credit scores are a niche within the credit card market; providers are more flexible than traditional lenders and charge a higher interest rate for outstanding balances and purchases.

Below are 4 credit cards that you can apply for, if you have a poor credit score and want to improve it.

Which Credit Cards can Help You?

Capital One

Click this link to be taken through to the website.

Vanquis

Click this link to be taken through to the website.

Aqua

Click this link to be taken through to the website.

Ocean Finance

Click this link to be taken through to the website.

If you do apply for any of these credit cards, please read all the terms and conditions carefully and pay particular attention to the APR that will be applied to your card. Use your new credit card responsibly and in a few short months your credit score will improve. As your credit score improves, you will be able to borrow at much more competitive interest rates. You can find out your credit score for free here.

Do you know your credit score? Have you had to take steps to improve it? Let me know in the comments section below.

If you have enjoyed this post you will also like the following posts:

Take This Free Financial Literacy Course Today

Cryptocurrency Exchange: This is Why I Recommend DSX

What to do if you are Made Redundant: 5 Steps

How to Control Your Cashflow With a Bill Payment Schedule

How to Boost Your Income With a Temporary Christmas Job – 4 Examples

Credit Cards: How to Make Balance Transfers Work For You

What’s the Best Strategy for Clearing Debts?

Save up to £300 per year by Changing Broadband Supplier

Investments: Why Saving is Not Enough

How to Stop Emotional Spending

My aim with each blog post is to help you move to a better financial future. I believe that there is not enough financial education in the national curriculum and I intend to share anything helpful that I have learned along the way. I am by no means a financial expert. None of the information on this website constitutes financial advice and is provided as general information only. This is my personal finance blog; my marketing blog is over here and I have been blogging there since 2010. I hope you have found this information useful. Thank you for reading.

Best regards,

Mike

*If you were wondering about the difference between a credit score and and credit rating, individuals usually have credit scores whereas businesses or governments have credit ratings. Credit ratings are expressed as letters with A being the highest as opposed to the numbers used for credit scores.

Image credit: https://upgradedpoints.com/